Industry

Insurance

Client

Enterprise (NDA)

Insurance Sales Platform — From Friction to Flow

🔑

Key Achievement

I unified two legacy systems into one streamlined sales flow, allowing agents to quote in seconds instead of minutes and correct data without restarting or calling support.

This removed early friction that previously pushed agents to competitors, reduced operational load on hotline support, and recovered sales momentum — contributing to a return to Top-2 preference in the agent market.

My role

I led the product design direction end-to-end — from discovery to delivery. I audited two legacy systems, interviewed agents and uncovered the need to pivot from service-first to sales-first.

I defined the information architecture, core Quote → Sale → Client flows, designed hi-fi prototypes with in-flow editing and fast quoting, and established the initial Design System that enabled the platform to scale.

In short, I shaped the vision, decisions and experience of the unified sales platform.

Context & Business Problem

Following the post-merger integration, advisors operated inside two environments never intended to coexist.

Two UIs, inconsistent logic, duplicated data entry — and when something blocked, it blocked hard.

Even a typo, new license plate or payment update meant calling support.

Wait time? Sometimes 40 minutes.

When quoting stalled, agents didn’t escalate.

They moved to another insurer. Instantly.

This wasn’t about UI improvement.

It was about stopping revenue leakage and restoring confidence that selling could happen fast — without waiting for help.

Where We Started — The Baseline State

The ecosystem was slow, fragmented and operationally expensive.

Agents switched between two systems with different mental models. Simple actions (fixing data, retrieving history, checking policy details) required support. Quoting demanded full forms, repeated RODO, and strict validations that stopped sales mid-flow.

Support wasn’t solving complexity — it was firefighting trivia.

The product wasn’t losing because of price.

It was losing because selling was slower than the competition.

My target became clear:

One platform. One flow. Zero hesitation during the sale.

Strategic Reframing & Key Design Decisions

The team planned to improve post-sales processes first — where support volume was highest.

Through research, I uncovered a more urgent truth:

Sales weren’t breaking at the end.

They were breaking at the first moment of friction.

If quoting doesn’t move, nothing else matters.

No offer → no sale → no retention → no cross-sell.

I shifted the roadmap completely:

From service-first → sales-first

My focus was momentum over complexity — removing places where users stop, wait or restart.

Design principles I established:

start quotes with minimal input → keep the conversation moving

let the system fetch data automatically → not the advisor

make corrections editable in-flow → no restart, no hotline

one mental model instead of two → clarity & speed

autonomy over escalation → advisors act, not wait

Not just features — an experience that sells.

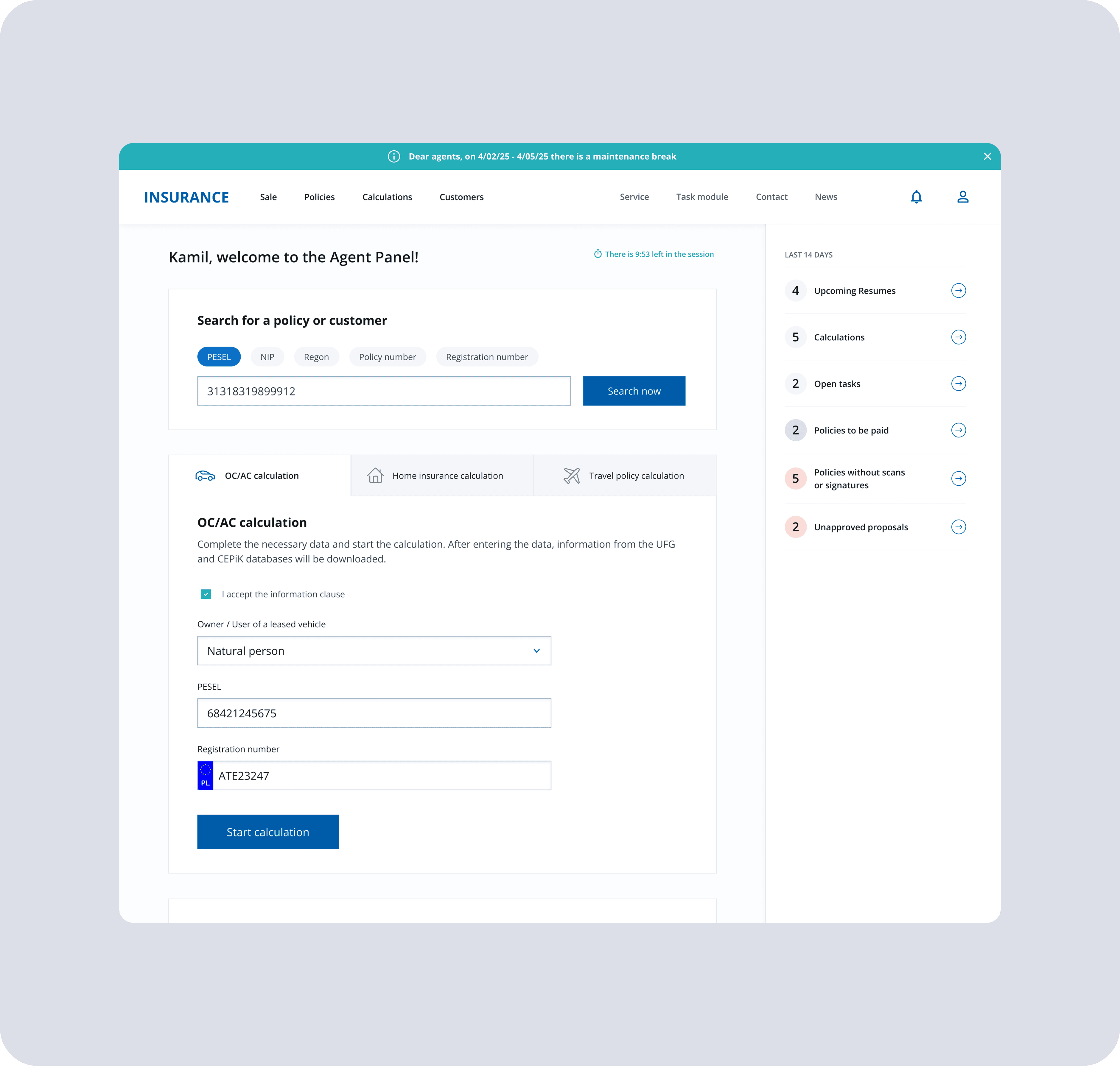

The Experience I Designed

From hesitation → to continuous forward motion.

Instead of demanding full data upfront, quoting can start from two fields — with the system handling the rest. Underwriting questions appear only when relevant, maintaining pace instead of blocking it.

Advisors no longer choose between systems. There is one entry point: global search, recent work, quick quote — intuitive and predictable.

Edits happen directly inside the flow.

No phone call. No restart. No break in rhythm.

Client history sits next to the sale — unlocking real cross-sell moments instead of separate tasks.

Before, each step risked a stall.

Now, momentum is the default state.

Motor Quoting — fast, logical, predictable

The quoting process was rebuilt from the ground up—simplified, automated, with fewer unnecessary questions and more auto-retrieved data—making it feel more like a conversation than a form.

Sales — the moment of truth, unlocked

Sales became seamless thanks to moving blocking questions, editable data, multiple policy-signing options, and a full set of payment methods, significantly improving agents’ workflow.

Search, Policy View and Client View — the 360° foundation

The new search, policy view, and client view create a cohesive, fast-to-use architecture — a foundation for a full 360° customer perspective and future cross-sell.

Outcomes — What Changed

This wasn’t a UI lift.

It was a new operating model for selling insurance.

For advisors, it means:

quoting that starts in seconds, not minutes

corrections without escalation to support

full client context for cross-sell opportunities

a predictable, confident sales flow

For the business, it means:

fewer hotline requests → lower cost to serve

reduced quote abandonment → more closed sales

improved competitive position in agent channels

→ Top-2 preferred insurer after launch

Most importantly — the platform didn’t just get better.

It gave sellers confidence and control again.